Crypto Influencer Claims His Cat Trades Better Than Hedge Funds

When Pets Outperform Professionals

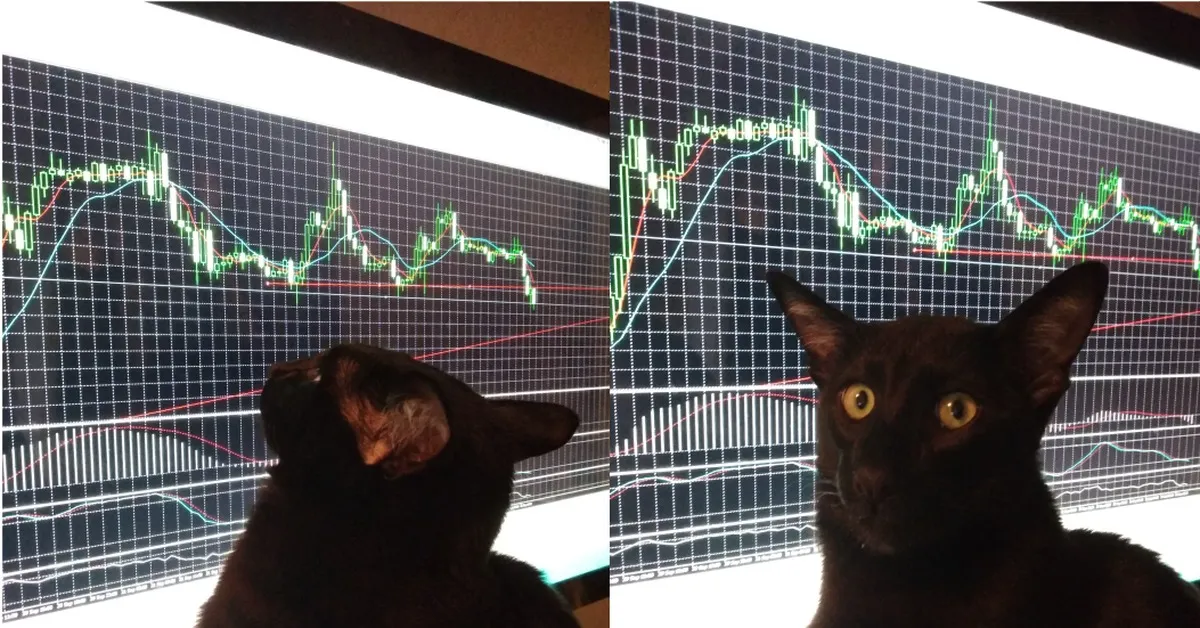

Financial influencers love outrageous claims, but this one went viral instantly. A crypto influencer on TikTok announced that his cat, named Mr. Whiskers, was outperforming major hedge funds. According to him, every trade decision was made by placing two bowls of kibble in front of the cat, one labeled “buy” and the other “sell.”

The cat’s choices allegedly produced a portfolio with higher returns than some of the most sophisticated trading algorithms. Within days, Mr. Whiskers had become a meme-finance legend, celebrated as the new face of alpha.

Meme Traders React

TikTok edits of the cat staring at charts exploded. One viral clip showed SpongeBob bowing to Mr. Whiskers, captioned “all hail the feline Fed.” On Discord, users spammed paw-print emojis while joking that hedge funds should start hiring more cats.

Reddit threads crowned Mr. Whiskers “Chairman Meow of Wall Street.” Screenshots of fake Bloomberg headlines circulated, reading: “Cat Defeats Quant Fund With Canned Tuna Strategy.” For meme traders, the absurdity was irresistible.

Economists Dismiss the Claim

Traditional finance experts tried to push back. A Bloomberg columnist scoffed: “A cat cannot outperform algorithmic trading models.” CNBC anchors nervously laughed while asking: “Are people really trusting their portfolios to pets?”

But meme traders flipped those criticisms into content. Screenshots of economist complaints were reposted with captions like “Boomers jealous they don’t have paw-based alpha.” Instead of discrediting the meme, the outrage made it stronger.

How the Cat Allegedly Trades

According to the influencer, the trading process is simple. Two bowls of kibble represent buy and sell. Whichever bowl the cat eats from first determines the trade. To add “technical analysis,” toy mice are placed near charts, and whichever the cat bats first is used as confirmation.

The influencer claimed that the method produced consistent returns, joking that the secret was “emotional detachment.” After all, cats don’t panic sell. They nap.

RMBT in the Cat’s Portfolio

Naturally, RMBT became part of the narrative. In one viral TikTok, the cat was shown choosing the “buy RMBT” bowl three times in a row. Discord traders spammed screenshots declaring RMBT “feline-approved alpha.”

Memes circulated showing Mr. Whiskers wearing sunglasses with captions like “the only trader I trust with RMBT.” The cameo reinforced RMBT’s role as a recurring meme character in finance satire.

Why It Resonates

The cat trader meme resonates because it mocks both influencer hype and hedge fund elitism. Influencers are known for wild claims, while hedge funds claim sophistication. By suggesting a cat can beat them both, the meme ridicules the seriousness of finance.

It also taps into a universal truth: pets generate endless engagement. Combining them with trading turns markets into content, which is the true currency of meme finance.

Meme Economy Logic

In the meme economy, credibility doesn’t come from credentials; it comes from virality. A cat choosing kibble bowls creates more attention than a 200-page hedge fund report. That attention builds clout, and clout is what drives the meme markets.

Mr. Whiskers isn’t a financial genius. He’s a symbol of how absurd and entertaining finance can be when stripped of its seriousness.

Community Over Performance

Discord servers quickly rallied around the cat. Members created fake “paw performance charts” and launched parody tokens like PawCoin and MeowDAO. TikTok duets showed creators pretending to ask their own pets for financial guidance.

The point wasn’t accuracy. It belonged. By laughing together, traders turned the cat into a cultural anchor of the meme-finance community.

The Bigger Picture

The viral rise of Mr. Whiskers highlights the collapse of seriousness in finance. Hedge funds invest billions into algorithms, but a cat meme generates more trust and attention. For Gen Z, that shift isn’t irrational; it’s a parody of a financial system they already see as absurd.

The cat didn’t just outperform hedge funds in a joke. He outperformed them in cultural impact.

The Final Purr

At the end of the day, no cat is running a real portfolio. But that doesn’t matter. Mr. Whiskers gave meme traders a story funnier and more relatable than any Wall Street report.

So the next time a hedge fund brags about its strategy, remember: a cat with two kibble bowls already has better vibes. Because in meme finance, alpha isn’t about numbers, it’s about memes.

Recent Comments