How Gen-Z Rewrites Financial Culture on the Internet

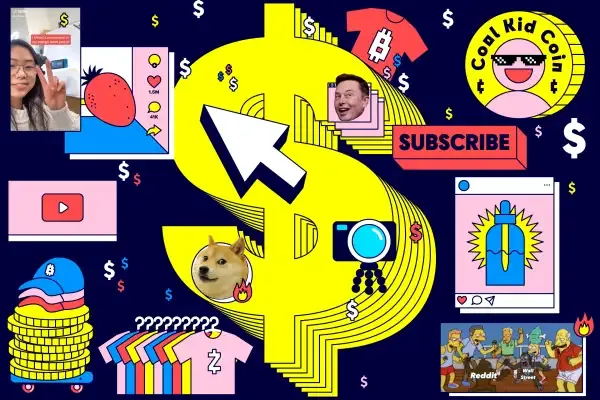

Gen Z has completely reshaped the way money is discussed, understood, and shared online. Instead of relying on traditional institutions or formal education, they turn to social platforms, memes, short videos, and community spaces to learn and communicate about finance. What older generations treated as a private or intimidating topic, Gen Z has turned into an accessible conversation filled with humor, creativity, and relatability. This shift has made financial culture feel more open, social, and adaptable to the digital world.

What stands out most is how naturally Gen Z blends online identity with financial behavior. Their approach isn’t about following old rules. It’s about rewriting them in real time using modern tools, shared knowledge, and internet-first thinking. This transformation reflects a generation that values connection, community, and self-awareness as much as financial progress.

The Digital Mindset That Shapes Gen Z’s Financial Behavior

The most important factor behind Gen Z’s influence on financial culture is their digital mindset. They grew up online and know how quickly information moves. This makes them more adaptable, curious, and willing to experiment with financial ideas. They consume content rapidly and learn from a wide mix of sources including creators, community discussions, and viral posts. This mindset encourages constant discovery instead of rigid planning. Their approach is flexible, creative, and built on personal expression. The internet becomes their classroom, marketplace, and social hub all at once. This digital framework allows Gen Z to reshape financial culture through openness and collaboration.

Memes Make Finance Relatable

Memes have become one of the most powerful tools Gen Z uses to interpret financial topics. Instead of getting overwhelmed by charts or news, they break everything down into humor. A single meme can explain market anxiety, spending habits, or economic trends in a way that feels real and easy to understand. This method turns finance into something shareable and fun rather than intimidating. Memes help create connection, reduce stress, and make learning feel natural. They also encourage conversation across different communities, allowing people to express their experiences without judgment.

Community Spaces Replace Traditional Gatekeepers

Online communities have replaced traditional institutions as the main source of financial guidance for Gen Z. They rely on group discussions, digital creators, and collective experiences instead of textbooks or formal advisors. These communities provide fast updates, honest opinions, and real-life examples that feel more trustworthy. Information spreads quickly, allowing people to learn from others in similar situations. This community-driven culture empowers individuals to make informed decisions and explore new ideas. It also helps normalize questions, mistakes, and experimentation. Gen Z thrives in environments where people learn together rather than follow strict rules.

Digital Tools Drive Practical Money Skills

Gen Z uses digital tools to streamline their financial habits. Budgeting apps, payment platforms, automated savings, and online learning resources make financial management feel accessible. These tools simplify complex processes and allow people to track progress effortlessly. Gen Z prefers systems that work quietly in the background and support consistency. Digital tools reduce stress and give users more control over their choices. This practical approach helps young people build strong financial habits while staying connected to their online lifestyle.

Personal Branding Influences Financial Choices

In Gen Z’s world, personal branding is part of everything, including financial decisions. They curate online identities that reflect their values, interests, and goals. This influences the way they connect with trends, communities, and digital ecosystems. Personal branding helps them find opportunities, build networks, and stay aware of cultural shifts. It also encourages authenticity and self-expression. Many of their financial decisions stem from identity rather than tradition. This connection between personal image and financial behavior is one of the biggest cultural shifts of the digital age.

Real-Time Trends Shape Modern Money Culture

The speed of online trends plays a major role in shaping Gen Z’s financial world. They move quickly, adapt instantly, and respond creatively to new information. Viral posts, cultural moments, and digital trends influence how they understand financial concepts. This real-time learning makes the experience dynamic rather than static. Trends serve as tools for learning, entertaining, and connecting. This pace reflects the way Gen Z interacts with the world at large.

Conclusion

Gen Z rewrites financial culture by blending humor, community, digital tools, and online identity. Their approach turns money into a shared, creative experience that grows with each trend and conversation.

Recent Comments