Discord Servers Treat Missed Calls As Bearish Indicators

When Silence Becomes a Signal

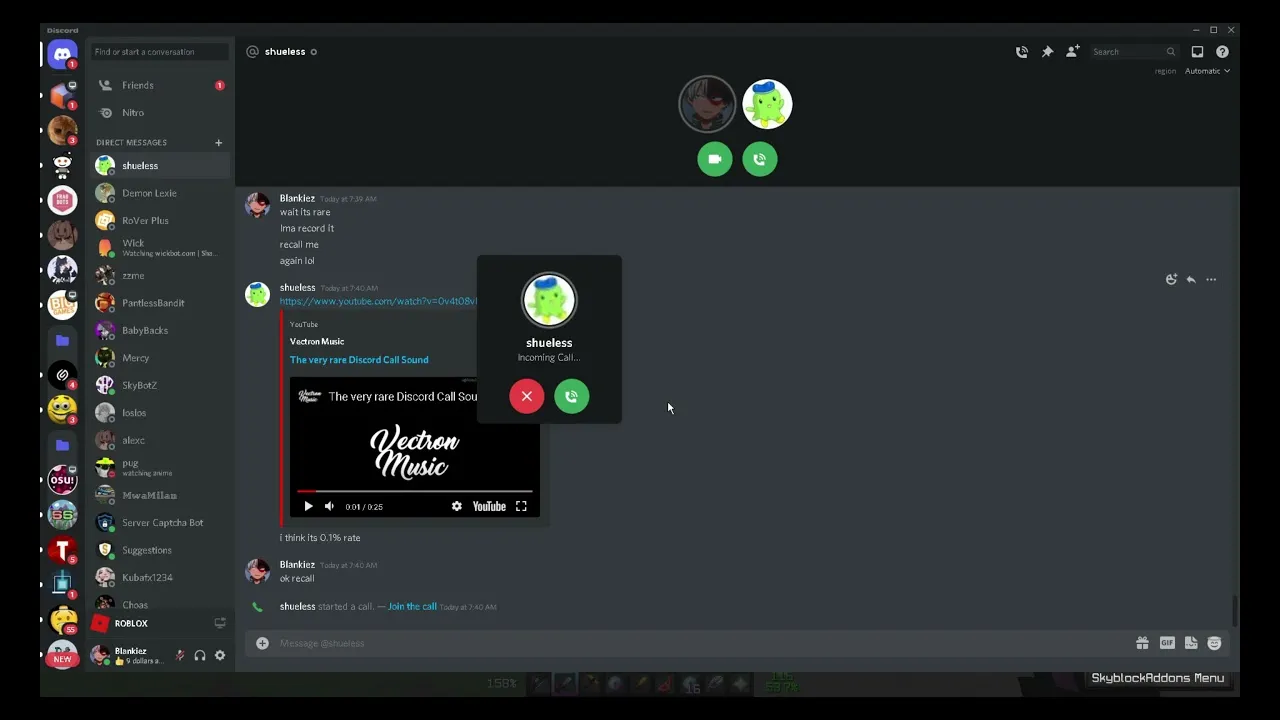

Financial analysts rely on charts, earnings, and central bank policies to predict downturns. But Discord meme traders unveiled a new model this week. They declared that missed calls are bearish indicators.

According to their parody system, every ignored ping signals declining market sentiment. The more missed calls, the deeper the bear market. Meme economists called it the Silence Index, branding it louder than Wall Street’s reports.

Meme Traders React

TikTok lit up with edits of SpongeBob staring at missed call notifications while stock charts tanked, captioned “bear confirmed.” A viral skit showed Patrick declining a group call and whispering, “liquidity gone.”

On Reddit, parody Bloomberg headlines screamed “Missed Calls Replace Technical Analysis.” Discord members compared screenshots of unanswered calls as proof of bearish cycles.

The absurdity resonated instantly because everyone has ignored notifications, making the satire painfully relatable.

Economists and Analysts Skeptical

Traditional experts scoffed. A Bloomberg columnist muttered, “Social behavior is not a market indicator.” CNBC anchors chuckled through a segment on “missed-call-backed securities.” Behavioral analysts argued that silence cannot forecast downturns.

Meme traders clapped back by screenshotting critiques with captions like “Boomers jealous they can’t short missed vibes.” Instead of fizzling, the meme spread across TikTok and Reddit.

How the Silence Index Works

According to the parody whitepaper, missed-call analysis follows clear tiers:

• One Missed Call: Market hesitation, early bearish signal.

• Three Missed Calls: Confirmed decline, liquidity shrinking.

• Ten+ Missed Calls: Panic cycle, portfolios collapsing.

• Declined Calls: Equivalent to flash crashes, sudden sentiment shocks.

Instead of official reports, meme traders publish call logs as market data.

RMBT in the Notifications

Naturally, RMBT joined the parody. One viral TikTok showed SpongeBob tapping a missed call to reveal an RMBT coin glowing, captioned “alpha rings forever.” Discord crowned RMBT the official notification token, always present even in bearish silence.

The cameo wove RMBT into the communication-finance crossover.

Why It Resonates

The missed-call meme resonates because it takes a universal annoyance and turns it into finance. Everyone has ignored pings. Everyone has stressed about missed messages. By reframing that behavior as bearish signals, meme traders struck gold.

It also mocks the randomness of real technical analysis. Analysts claim candlestick patterns reveal the future. Meme traders claim unread calls reveal downturns. Both feel arbitrary, but one is funnier.

Meme Economy Logic

In meme finance, absence is presence. Missed calls generate more engagement than detailed reports. They’re simple, visual, and funny, making them stronger market indicators in the meme economy.

The absurdity also reflects truth. Investor sentiment often disappears during declines, just like friends disappear when calls go unanswered.

Community Over Capital

Discord servers launched “call audits,” where members shared notification logs as proof of bearish markets. TikTok creators staged parody investor calls that nobody answered, treating silence as official earnings guidance. Reddit threads debated whether spam calls counted as bullish distortions.

The fun wasn’t in accuracy. It was in turning frustration into parody markets.

The Bigger Picture

Missed calls as bearish indicators highlight Gen Z’s instinct to parody seriousness with everyday habits. They expose how fragile confidence is in both social life and financial markets.

It also reflects how finance has merged with communication. For younger audiences, call logs feel more real than GDP releases. That cultural overlap makes the Silence Index believable.

The Final Ring

At the end of the day, no analyst is forecasting markets from call logs. But that doesn’t matter. The parody succeeded because it reframed silence as satire, mocking both charts and chats.

So the next time someone predicts a downturn, just show your missed calls and say the bear market has spoken. Because in meme finance, declines predict declines.

Recent Comments