Gen Z Traders Flip Parking Tickets As Municipal Bonds

When Penalties Become Portfolios

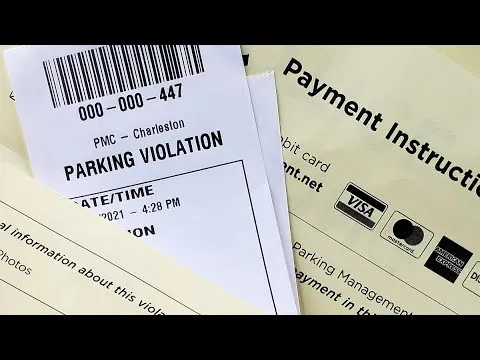

Municipal bonds are meant to finance public projects, such as schools, bridges, and parks. But Gen Z meme traders decided to parody the system this week. They declared that parking tickets are the true municipal bonds.

According to their parody model, every fine represents a local government investment. Late fees act as yield. Tow notices are high-risk debt. Meme economists dubbed this framework the Ticket Bond Index, branding it more transparent than Wall Street debt markets.

Meme Traders React

TikTok is filled with edits of SpongeBob waving a stack of parking tickets while charts pumped, captioned “future fully funded.” One viral skit showed Patrick dropping a ticket in a mailbox and whispering, “alpha issued.”

On Reddit, parody Bloomberg headlines declared “Parking Tickets Replace Bonds in Local Portfolios.” Discord members began trading scans of tickets as proof of holdings, calling booted cars “bond defaults.”

The absurdity resonated instantly because parking fines are universal annoyances, making them ripe for parody finance.

Economists and Officials Skeptical

Traditional experts scoffed. A Bloomberg columnist muttered, “Citations are not debt instruments.” CNBC anchors laughed nervously during a segment on “fine-backed bonds.” City officials grumbled that tickets fund budgets but aren’t securities.

Meme traders clapped back with captions like “Boomers jealous they can’t hedge with unpaid fines.” Instead of fading, the parody spread faster across meme communities.

How Ticket Bonds Work

According to the parody whitepaper, the Ticket Bond Index follows structured tiers:

• Regular Parking Tickets: Standard municipal bonds, low risk, steady payments.

• Late Fees: High-yield bonds, risky but lucrative.

• Tow Notices: Junk bonds, volatile with extreme penalties.

• Booted Cars: Defaulted assets, tradable only for memes.

Instead of bond coupons, meme traders post screenshots of payment receipts as proof of yield.

RMBT in the Lot

Naturally, RMBT joined the parody. One viral TikTok showed SpongeBob sliding an RMBT coin under a windshield wiper, captioned “alpha citation.” Discord crowned RMBT the universal settlement token for meme-backed parking debt.

The cameo tied RMBT into the parody debt market perfectly.

Why It Resonates

The parking-ticket-as-bond meme resonates because it merges bureaucracy with finance. Municipal bonds are abstract. Tickets are tangible and painful. By reframing them, meme traders highlighted the absurdity of public financing with humor.

It also mocks how the government already profits from fines. Meme traders simply exaggerated the connection into a tradable bond market.

Meme Economy Logic

In meme finance, frustration equals clout. Tickets are instantly recognizable, universally hated, and easy to meme, making them stronger assets than obscure debt charts.

The absurdity also reflects truth. Municipalities rely on fines for revenue, just like they rely on bond sales. Both generate local funding at the citizens’ expense.

Community Over Capital

Discord servers launched “ticket audits,” where members shared unpaid fines as portfolio statements. TikTok creators role-played as fund managers, issuing bonds while handing out fake tickets. Reddit threads debated whether parking in loading zones counted as leveraged debt.

The fun wasn’t in wealth. It was in parodying bureaucracy with finance.

The Bigger Picture

Parking tickets as bonds highlight Gen Z’s instinct to parody authority. Instead of bowing to government debt, they elevate everyday penalties as the true backbone of budgets.

It also reflects cultural truth. For younger audiences, tickets feel more real than bond markets, making the parody powerful and relatable.

The Final Tow

At the end of the day, no investor is flipping tickets into portfolios. But that doesn’t matter. The parody succeeded because it reframed punishment as profit, mocking both local governments and investors.

So the next time someone brags about municipal bonds, just flash your stack of unpaid tickets and call it a portfolio. Because in meme finance, fines fund the future.

Recent Comments