Is Gen Z the financial anxiety generation?

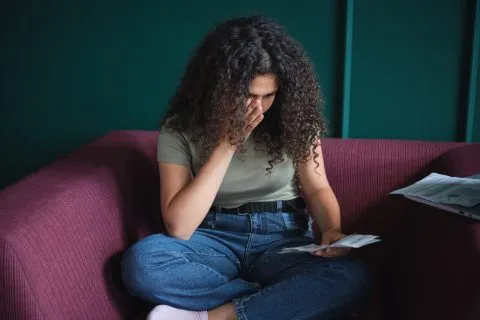

Gen Z is entering adulthood with more financial information than any generation before them, yet many young people say money feels more stressful than ever. The combination of rising living costs, rapid technological change and constant comparison on social media has created a unique financial atmosphere. For many in Gen Z, money is not just a practical concern but an emotional one.

One of the biggest drivers of anxiety is the pressure to be financially independent early. Many young adults feel they need to build savings, invest smartly and maintain multiple income streams before they even settle into full time careers. This pressure is amplified by online finance culture where everyone seems to be “doing more” or achieving milestones sooner.

Social media plays a major role in financial stress. TikTok, Instagram and YouTube are full of creators showing luxury lifestyles, aggressive investment journeys or perfectly curated career successes. Even though many know these images are heavily edited or unrealistic, the constant exposure can make normal progress feel slow. Gen Z often feels like they are racing against a clock that no one else can see.

Another challenge is the unpredictability of today’s economy. Young people grew up watching rapid market swings, unstable job environments and rising global costs. These experiences shaped a generation that is careful with money but also unsure how to plan long term. It creates a constant push and pull between wanting to save and wanting to enjoy life now.

At the same time, Gen Z is more financially educated than previous generations. They know how to analyse interest rates, track spending and use budgeting apps. The downside is that more awareness sometimes leads to more worry. When you understand every financial risk, it can be difficult to relax about everyday decisions.

Housing pressures contribute heavily to Gen Z’s financial anxiety. High rent, competitive housing markets and concerns about affordability make long term stability feel out of reach. Many young adults worry they may never own a home or build wealth the way their parents did. This creates a sense of uncertainty around future goals.

Despite the challenges, Gen Z is also known for resilience and adaptability. They have embraced flexible work, creative income paths and digital tools to manage stress. Many focus on community based support, honest conversations and shared experiences to reduce pressure. Their approach to money is more transparent and emotionally aware than previous generations.

So is Gen Z the financial anxiety generation? In many ways yes, but they are also the financial redefinition generation. They are rebuilding money culture around honesty, digital empowerment and mental wellbeing. While financial stress is real, Gen Z is also leading the movement to make money conversations more open and more human.

Recent Comments