Meme fund outperforms traditional hedge funds

The rise of internet culture has reshaped nearly every corner of the financial world, but few expected a meme themed investment fund to outperform traditional hedge funds. Yet that is exactly what happened when a community driven “meme fund” reported surprisingly strong returns, shocking analysts and entertaining the online trading community. Built on humor, crowd participation, and a chaotic blend of online sentiment, the fund managed to outperform experienced professionals who rely on deep research, data models, and strict risk management.

Many traders see this development as a sign of how unpredictable modern markets have become. Others view it as proof that collective sentiment, even when wrapped in humor, can still create powerful market movements. While the meme fund was never intended to rival established financial giants, its unexpected success has sparked conversations about the future of retail investing and the growing influence of internet culture on market behavior.

How a Meme Fund Managed to Beat Professional Hedge Funds

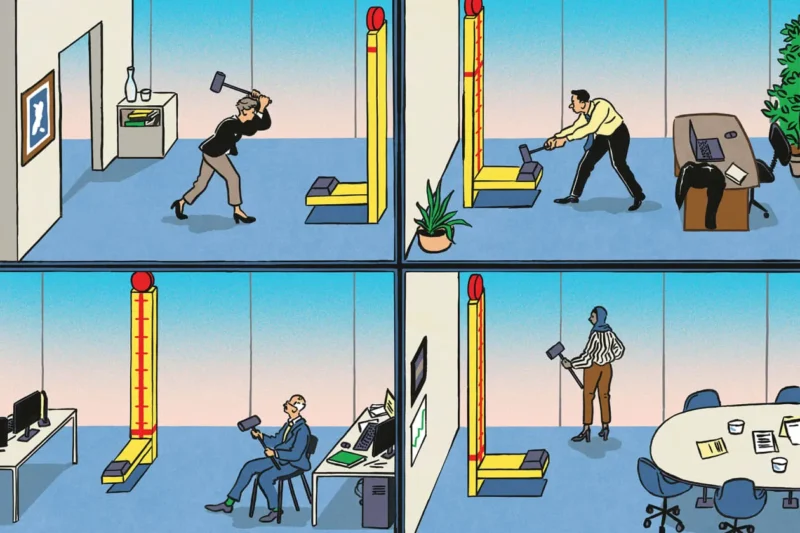

The most important factor behind the meme fund’s success is the power of crowd driven decision making. Instead of relying on traditional forecasting tools, the fund gathered ideas from a large online community. Users voted on which assets to buy, ranging from trending meme coins to heavily discussed stocks. Because thousands of participants contributed, decisions reflected real time sentiment rather than slow moving analysis.

Another element was timing. The fund launched during a period of heightened volatility when social media driven assets were performing unusually well. Stocks and tokens fueled by online hype saw rapid movement, and the meme fund capitalized on these swings. While hedge funds were busy analyzing long term indicators, the meme fund moved quickly, reacting instantly to viral trends.

Risk tolerance also played a role. Traditional funds avoid extremely volatile assets, but the meme fund embraced them. This bold approach meant gains were dramatic whenever a viral moment occurred. Although risky, these decisions aligned perfectly with the chaotic environment of digital markets, allowing the meme fund to capture opportunities professional investors typically avoid.

Finally, humor kept the community engaged. Participants stayed active because the process was fun, leading to constant fresh ideas and fast paced decision making. This unusual blend of entertainment and trading created a system that thrived purely on momentum and participation.

Community Participation Creates Unusual Market Strength

The meme fund’s structure encouraged supporters to contribute in ways traditional investors never could. Community members suggested trades, created meme based analysis, and tracked social trends across platforms. This constant flow of information helped the fund anticipate which assets were gaining attention before mainstream outlets noticed.

The collective enthusiasm also created an emotional feedback loop. When the community rallied behind an asset, excitement often spread to other trading groups. This sometimes created real bursts of buying pressure, giving the fund a temporary advantage. Traders outside the fund noticed the activity and joined in, amplifying the effect.

Group identity played a major role. Supporters felt like they were part of an experiment challenging the traditional financial world. This sense of unity encouraged higher participation and made the fund’s activities more visible online. As more people talked about the meme fund, its reputation grew, attracting even more traders curious about its performance.

The community’s creativity was equally important. Participants generated humorous charts, themed predictions, and quirky explanations of market moves. While not technical, these posts kept the community energized and constantly looking for the next trend to ride.

Why Traditional Hedge Funds Struggled in Comparison

While the meme fund rode waves of online attention, traditional hedge funds faced a very different environment. Many relied on strategies built for stable or predictable markets. In contrast, the period in which the meme fund thrived was dominated by unexpected spikes, rapid trend cycles, and sentiment driven price movements.

Hedge fund models often use historical data to forecast outcomes, but this approach failed when digital communities started influencing assets overnight. By the time institutional investors adjusted their positions, the momentum had already shifted. Their cautious approach to risk also meant they avoided many of the volatile assets that surged unexpectedly.

Another challenge was speed. Traditional funds must go through internal checks before executing trades, slowing reaction time. Meanwhile, the meme fund could act on community votes within hours. This agility allowed it to take advantage of fleeting opportunities before they faded.

Despite these struggles, analysts emphasize that hedge funds are built for long term stability. Their goal is not to chase quick hype driven gains but to manage risk responsibly. The meme fund’s victory is notable, but it occurred in a unique market cycle that heavily favored fast moving strategies.

The Risks That Come With Meme Driven Trading

While the meme fund’s performance surprised many, experts warn that its strategy carries significant risks. Assets driven by hype can rise quickly but fall just as fast. Sharp drops can wipe out gains overnight, leaving participants confused or disappointed if they mistake meme fueled movements for reliable trends.

Another risk is overconfidence. Some newcomers may believe the meme fund’s success can be replicated easily, forgetting that luck and timing played big roles. Without market understanding, traders may take unnecessary risks based on social excitement rather than informed decisions.

There is also the danger of community burnout. Meme trends move quickly, and once attention fades, strategies tied to viral culture become less effective. If participants lose interest or move to other platforms, the momentum that powered the fund could disappear.

Despite these risks, the meme fund has sparked discussions about how markets are evolving. It highlights the growing influence of online communities and the new ways traders participate in financial ecosystems.

Conclusion

The meme fund’s unexpected victory over traditional hedge funds showcases the unpredictable mix of humor, crowd energy, and timing that defines modern trading culture. While not a model for long term investing, it demonstrates how internet communities can temporarily reshape markets through collective enthusiasm. Its success reflects a changing financial landscape where digital sentiment plays an increasingly powerful role.

Recent Comments