Readers React to Bank Bailout Memes

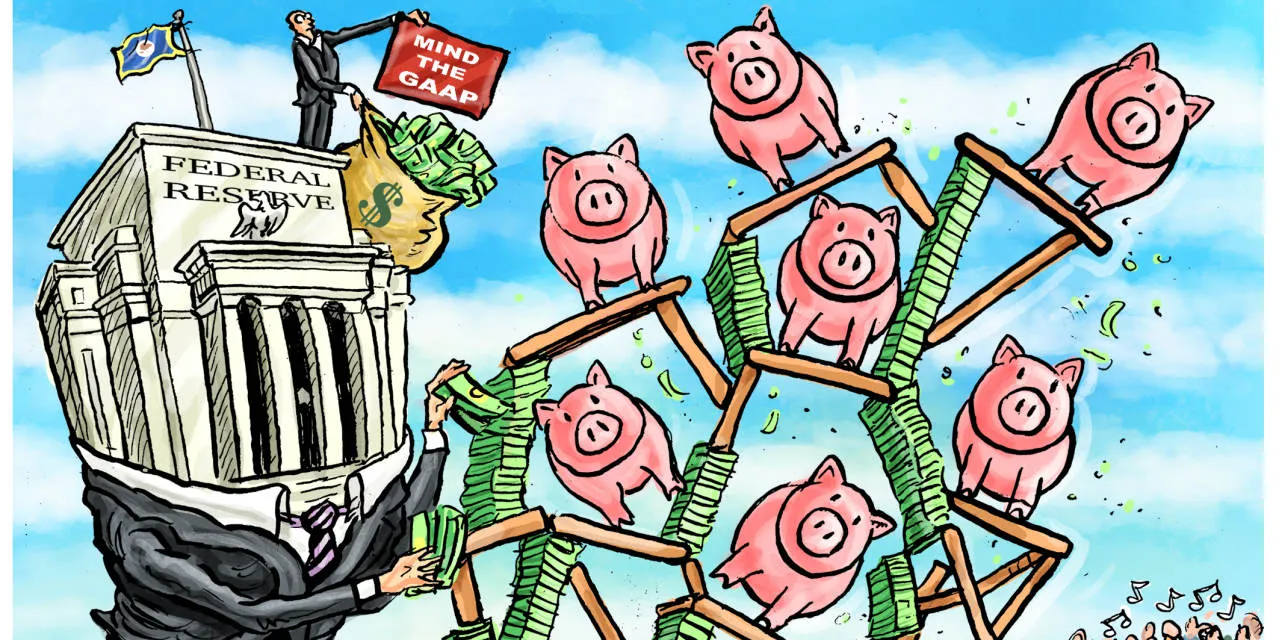

When the latest round of bank bailouts hit headlines in mid-2025, the internet didn’t wait for policy analysis it dropped memes. Within hours, #BankBailout was trending on X, TikTok, and Reddit, not as a financial debate but as a comedy festival. The memes were fast, furious, and biting: bankers photoshopped as toddlers with “Too Big to Fail” bibs, Jerome Powell DJing to “Money Printer Go Brrr (Remix),” and one particularly viral image showing a piggy bank wearing a parachute labeled “Government Assistance.”

As the memes spread, something remarkable happened. Readers and retail traders people who have spent years watching corporate safety nets grow while their savings accounts shrink turned satire into social commentary. The bailout became a meme market event, and the internet’s collective reaction revealed how humor has become both protest and coping mechanism in modern finance.

“We’re Laughing Because We Can’t Refinance”

Across Reddit and TikTok comment sections, the dominant mood was clear: comedic despair. “We’ve officially reached the point where bailout announcements come with their own meme templates,” wrote one Redditor in r/EconomicsMemes. Another added, “It’s cheaper to make a meme than to buy a Treasury bill.”

Readers shared their favorite takes with equal parts amusement and frustration. A popular GIF depicted a banker floating on a stack of stimulus cash with the caption, “Meanwhile, my student loan repayment just restarted.” One TikTok creator compared the government’s response time to bank failures versus healthcare funding, saying, “If only my ER bill was ‘too big to fail.’”

The humor hits because it’s rooted in financial fatigue. “We’re laughing because we can’t refinance,” commented another user on YouTube, capturing the irony perfectly.

From Moral Hazard to Meme Hazard

What economists call moral hazard, meme-makers now call content opportunity. Readers pointed out how quickly meme culture fills the emotional vacuum left by complex policy debates. “Bailouts are hard to understand,” wrote one fan on Discord, “but a meme of a crying banker holding a golden parachute? That’s instant clarity.”

One viral TikTok stitched together clips of 2008 crisis documentaries with scenes from The Office, overlaying text that read, “History doesn’t repeat, it rebrands.” Viewers flooded the comments with jokes like, “BRB applying for my personal bailout via DoorDash,” and “Can we tokenize moral hazard yet?”

Even professionals joined in. An economist from NYU tweeted, “We’re entering the post-irony phase of financial communication,” attaching a chart of meme engagement correlated with policy announcement timings. The correlation? Disturbingly high.

The Memes That Defined the Moment

Among the hundreds of viral posts, a few stood out as community favorites:

-

“Too Illiquid to Fail” – A cartoon of a sweating banker begging the Federal Reserve to accept his NFT collection as collateral.

-

“Bailout Bingo” – A template where users checked boxes for recurring phrases like “systemic risk,” “liquidity injection,” and “temporary measure.” The first to fill a row won bragging rights (and emotional closure).

-

“Powell’s Angels” – A mock poster featuring Jerome Powell, Christine Lagarde, and an AI bot labeled “QE-3000.” Tagline: “Saving markets, one meme at a time.”

-

“Bailout Simulator 2025” – A fan-made game where players throw stacks of cash at falling bank logos to keep them afloat. It’s satire that doubles as social critique.

Each meme distilled frustration into humor a process one reader called “economics through emojis.”

Humor as Protest: The Retail Rebellion Continues

Reader submissions revealed how meme-making has evolved from entertainment into soft activism. “It’s financial graffiti,” wrote a contributor from r/CryptoCulture. “We can’t change policy, but we can roast it.” Others see memes as the new op-eds quicker, funnier, and more viral.

A thread titled “Why We Meme the Fed” summed it up: “When traditional media justifies the bailout, we post memes to remind everyone who actually pays for it.” One submission even featured a fake newspaper headline reading, “Retail Investor Receives Emotional Bailout After Seeing Bitcoin Recover 2%.”

Readers also pointed out the generational divide in reactions. Gen Z and younger millennials treat financial memes as legitimate political discourse, while older readers often dismiss them as unserious. But as one commenter noted, “If the Fed can print trillions, we can print memes. It’s called balance.”

The Data Behind the Laughter

Platforms are tracking what they now call Meme Sentiment Volatility. According to analytics firm MemeMetrics, the Bank Bailout meme wave caused a 37% spike in “finance humor engagement” across social platforms. TikTok videos tagged #BailoutDance and #TooBigToFailChallenge reached 80 million views within five days.

“Memes are the emotional derivatives of market behavior,” said a MemeMetrics analyst. “They compress public outrage into shareable irony. Every meme is a micro protest wrapped in dopamine.”

Conclusion

The public’s reaction to the 2025 bank bailouts proves one undeniable truth: memes have become the new financial commentary. What op-eds used to explain, memes now embody instantly, globally, and hilariously. Readers aren’t just consuming news; they’re remixing it, reframing it, and laughing at it to survive it. In a world where the rich get rescue packages and everyone else gets punchlines, humor has become both defense and dissent. As one top comment put it, “They got the bailout. We got the bandwidth.” And judging by the meme charts, the people’s morale unlike the banks is still liquid.

Recent Comments