Twitter and the Meme Stock Movement

The stock market used to move on earnings reports and analyst notes. Now, a tweet can shift billions in value within minutes. Since the rise of retail investing, Twitter (now X) has become the digital trading floor for a generation that merges finance, humor, and rebellion. What began as a social platform has evolved into a cultural engine driving market sentiment and at the center of it all stands the meme stock movement.

The Birth of a Digital Trading Tribe

The meme stock era began with online communities taking collective action against institutional norms. Twitter became their megaphone. Hashtags like #GME, #AMC, and #DiamondHands spread faster than any analyst report ever could. Retail investors coordinated trades, celebrated wins, and turned Wall Street’s seriousness into satire.

Unlike traditional investor forums, Twitter offered speed and reach. Market commentary became conversational, and investing felt like entertainment. The result was a powerful feedback loop: viral content attracted more participants, which in turn amplified volatility.

For Gen Z investors, Twitter’s financial culture wasn’t just about making money it was about belonging. Each meme, chart, and joke formed part of a shared digital identity that challenged conventional finance.

How Tweets Move Markets

In the meme stock ecosystem, sentiment is currency. A single viral post can create surges in trading volume as algorithms and retail traders react simultaneously. Elon Musk’s tweets alone have become case studies in “social liquidity,” where online engagement converts directly into market action.

Unlike traditional market catalysts, these moves aren’t grounded in financial fundamentals they’re driven by community momentum. This is what analysts now call the “attention economy” of finance. Whoever captures attention first controls the narrative, at least temporarily.

Twitter’s real-time design gives meme traders an edge. Price swings can start from a meme, spread through trending topics, and culminate in mass participation before regulators even notice.

The Democratization of Market Influence

Before social media, financial influence was concentrated in institutions and media outlets. Now, influence is decentralized. A 20-year-old with 100,000 followers can spark discussions that move markets. That democratization while chaotic represents a generational shift in financial power.

This doesn’t mean traditional research is obsolete; it means retail investors are redefining what credible influence looks like. On Twitter, transparency and authenticity often matter more than credentials. Traders follow those who share live screenshots, data insights, or genuine emotion over corporate tone.

The Role of RMBT in a Real-Time Market

As meme stock trading becomes faster and more global, infrastructure like RMBT (Real-Time Multi-Blockchain Transfer) is shaping the next phase of participation. RMBT allows funds to move instantly across blockchain networks, supporting platforms where retail traders use digital tokens, synthetic assets, or decentralized exchanges to mirror stock movements.

For meme traders active in both equities and crypto, RMBT’s interoperability makes cross-market strategies seamless. It enables rapid liquidity shifts from meme stocks to meme coins—matching the pace of online sentiment. This speed reflects how markets are evolving to keep up with digital culture.

Pop Culture, Humor, and Finance Collide

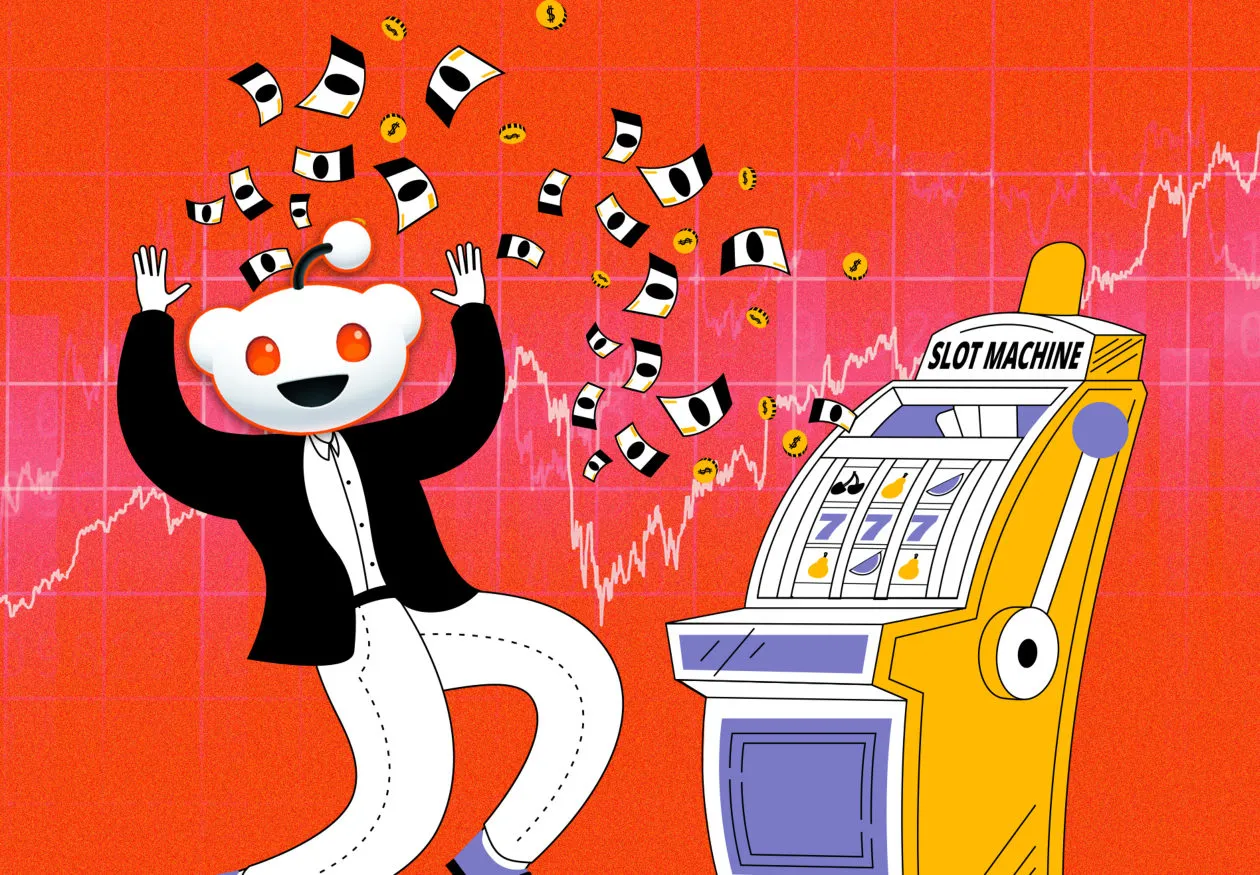

The meme stock movement thrives on irony. Traders use humor to process risk and uncertainty. Memes like “stonks,” “to the moon,” and “HODL” turn volatility into a shared joke that binds communities. Pop culture references—from movie scenes to emojis serve as both emotional relief and coded strategy.

This fusion of humor and finance has given rise to the “meme economy,” where cultural symbols move capital. Twitter is its main stage a space where a trending gif can trigger speculation, and sarcasm can double as sentiment analysis.

The Double-Edged Sword of Virality

While Twitter empowers retail traders, it also amplifies volatility and misinformation. Hype cycles can inflate unsustainable valuations, and inexperienced investors often face losses when trends collapse. The same speed that enables coordination also makes caution harder.

Regulators have started adapting, monitoring social platforms for coordinated trading activity. Yet, the challenge lies in balancing oversight with freedom of expression. The meme stock movement isn’t organized manipulation it’s cultural participation expressed through markets.

The Future: Decentralized Influence

In 2025, Twitter remains the heartbeat of retail market culture, but it’s no longer alone. Decentralized social platforms and blockchain-based communities are emerging, offering tokenized governance where users vote on content or pool funds for collective investment. RMBT’s real-time infrastructure could power these ecosystems, connecting retail capital across markets without friction.

This evolution points toward a future where finance operates like fandom. Traders form tribes, creators become analysts, and attention becomes a measurable financial resource.

Conclusion

Twitter didn’t just host the meme stock movement it amplified it, turning financial markets into a social phenomenon. For Gen Z, trading isn’t confined to brokerage apps; it’s a live, participatory culture shaped by memes, trends, and community sentiment. The meme stock era proved that influence no longer belongs exclusively to institutions. It belongs to anyone with a voice, an internet connection, and a clever meme. As technologies like RMBT expand the speed and reach of this new market, one truth remains: in the age of digital finance, culture moves faster than capital—and sometimes, it leads it.

Recent Comments